car insurance cheapest car affordable car insurance

car insurance cheapest car affordable car insurance

Usually, most individuals assume that smaller sized cars such as cars are a lot more manoeuvrable and also, thus, most likely to trigger mishaps. This is even supported by stats that prove smaller sized and sportier lorries are driven at higher speeds and also by younger, riskier drivers. Due to the fact that these vehicles are most likely to be entailed in more accidents, they likewise become a lot more pricey to guarantee. prices.

laws automobile cheap car insurance affordable

laws automobile cheap car insurance affordable

5 billion per year. It's apparent that insurance coverage solution suppliers are undoubtedly paying out - cheap insurance.

Uninsured Drivers, Of program, obtaining car insurance policy coverage is the ideal thing to do., the price of vehicle drivers without this all-important policy enhanced from 12.

The Insurance policy Study Council even adds that uninsured claims passed the$2 billion as of 2012. It's evident that insurance providers experience substantial losses when attempting to deal with uninsured insurance claims.

A Low Credit Rating, It's the global custom for lending institutions to evaluate your credit report prior to determining your finance repayment capability. And as it ends up, the pattern is now widespread in the auto insurance coverage room. The insurance provider have wrapped up that clients with reduced credit score scores are more probable to be associated with accidents. insurance company.

Thankfully, states like The golden state bar insurer from utilizing a customer's credit history to establish the costs rates. Nonetheless, you have one even more strong factor to boost your credit history. Much more Drivers when traveling, The most obvious reason a lot more crashes are taking place is due to people driving more.

The Single Strategy To Use For Why Safer Cars Don't Lead To Cheaper Car Insurance ... Yet

Insurance coverage experts worldwide additionally claim that people are driving extra miles thanks to the improving economic situations. Even those that are jobless can pleasantly drive now. In other words, a lot more driving can indicate more mishaps and also more rates across the board. Save Yourself, Despite these elements at play, you should not pay a penny much more for your automobile insurance if you're not comfy with the numbers.

Some people decide for obligation rather of full protection, raising deductible, and of program, checking out the terms thoroughly - car. Info and also research study in this write-up verified by ASE-certified Master Professional of.

Sources: This material is developed and maintained by a 3rd celebration, and also imported onto this page to aid users provide their email addresses (cheap auto insurance). You might have the ability to find more information about this and also similar web content at.

The pandemic sparked a change in the world of cars and truck insurance coverage. 4 billion in reimbursements, car insurance revenues enhanced as fewer Americans drove and the number of automobile insurance claims dropped. car.

Below's why prices could increase and how you can locate economical vehicle insurance if they do. Increased demand from vehicle drivers as well as a semiconductor lack has made brand-new and used cars much more costly, and it's expected to add to a rise in prices this year, according to a research from Swiss Re Institute, the research-focused department of Swiss Re Team, among the biggest reinsurance firms worldwide.

cheapest car insurance cheaper cars cheapest car affordable car insurance

cheapest car insurance cheaper cars cheapest car affordable car insurance

This boosted price methods more expensive claims for insurers, and insurance claims are already anticipated to return to pre-pandemic numbers this year. Furthermore, there's a grease monkey shortage. There was a sharp decline in the number of working mechanics in 2020, according to a study of vehicle service technician supply-and-demand from Technology, Force Foundation, a not-for-profit that offers sources to aspiring automobile professionals (low cost auto).

The Basic Principles Of How Claims Affect Your Insurance Rate - I Drive Safely

Cars and truck mishaps triggered by distracted driving have gotten on the rise for many years (cheaper cars). While phone usage is a typical diversion, vehicle drivers are likewise reading, eating, using makeup or busied with their youngsters while behind the wheel. money. Sidetracked driving caused 9% of fatal auto crashes in 2019, according to one of the most current data offered from the National Freeway Website Traffic Safety Management.

Motorists appear to additionally be speeding more because the pandemic started, which implies a higher likelihood of automobile accidents. A survey of 500 united state vehicle drivers done by Erie Insurance found that a person in 10 motorists claimed they drove much faster than normal at the start of the pandemic. In fact, speeding has actually ended up being such a trouble that campaigns have actually been released in Maryland and also Virginia to develop speed-reduction methods that can be applied throughout other states.

Ten states, including Texas as well as Michigan, saw ordinary declines of $112 or more. Of the states that did see rate increases, the average yearly increase was $83, a bit more than 5% over 2020 prices. insure. Meanwhile, the national consumer-price index for electric motor vehicle insurance policy saw a decrease of 3. 7% compared to 2020, according to data from the U.S

This pattern isn't most likely to continue. Major car insurers have actually filed to raise rates this year in some states as even more chauffeurs are back on the roadway and also the variety of car claims is expected to boost. If you do see an expense increase in your automobile insurance, you have options: Insurance providers often use discounts for things Home page like obtaining your costs through e-mail, taking a protective chauffeur course or being a constantly safe driver. liability.

, which is commonly the most affordable automobile insurance option. While you shouldn't cut protection simply to save money, you can drop comprehensive and collision protection if you drive an older car, as they pay out only as much as the current market worth of the auto minus your deductible. Shopping around for brand-new automobile insurance coverage quotes is normally the best means to conserve.

Geek, Wallet recommends searching at least yearly to assure you're getting the most effective deal. Ben Moore writes for Nerd, Pocketbook - insurance affordable. Email:.

Get This Report on Texas Auto Insurers Are Planning Big Rate Hikes In 2022 - The ...

cheapest auto insurance low-cost auto insurance suvs car

cheapest auto insurance low-cost auto insurance suvs car

Wondering why your auto insurance went up? You can regulate some of these reasons, like: You can't manage other usual reasons for cars and truck insurance coverage rate boosts, however, such as: Besides learning why auto insurance coverage firms raise your prices, you'll likewise find out just how to decrease your auto insurance policy costs after they go up. cheapest.

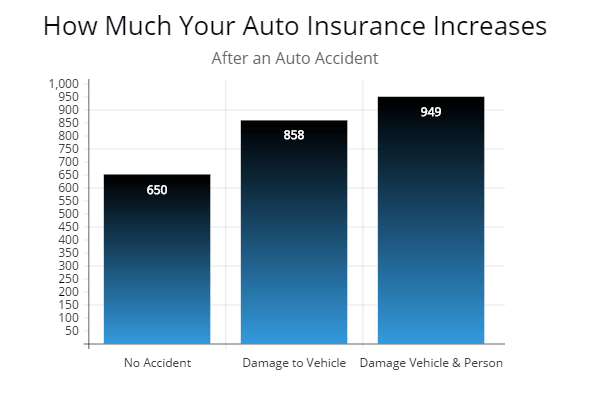

They might go up when it comes time to restore your policy. This is just one of the major reasons why some individuals select to spend for minor auto crashes expense. trucks. In most cases, it winds up being cheaper than suing. That's because insurance claims remain on your insurance coverage record for 3 years in a lot of states.

If you just recently got into an accident, that could be why your cars and truck insurance went up - credit. The exact same is true of tickets or citations. Both tickets and also citations can make your automobile insurance coverage increase, specifically if you've received greater than one in the last couple of years, or if the ticket or citation was for something serious.